Figure 1: Household Income

Copyright © 2012 jsd

On Thursday Dec. 20th, House Speaker John Boehner was humiliated by his own party when they refused to vote for his proposal, the so-called Plan B, otherwise known as the Morning-After Bill. He should have known all along that this was a lose/lose/lose proposition. It set the threshold too high to please the technocrats, yet too low to please the cynical political hacks.

As will be explained below, this incident is powerful additional evidence (if any were needed) that Republican legislators don’t care about voters and don’t care about the economy (short-term or long-term). They don’t even care about moderately rich people. All they care about is their ultra-super-rich donors. It’s not about disrespecting 47% of the voters or even 99% of the voters. It’s more like 99.98% of the voters.

For more than a year, President Obama has been campaigning to raise the marginal tax rate on whatever income an individual makes above a certain threshold, namely $250,000.00. This will have no effect on 98% of the families, i.e. the ones that make less than $250k. This proposal makes good economic sense, and enjoys wide popular support. Even a majority of Republicans support the idea. The Speaker’s proposal was similar, except that it set the threshold much higher, namely $1,000,000.00. It is easy to understand why this makes no sense economically or politically.

The only thing that is hard to understand is why the proponents of Plan B didn’t realize what a turkey it was. For two years, ever since he became speaker, Rachel Maddow has been exploring the hypothesis that John Boehner is bad at his job. The Plan B fiasco certainly supports this hypothesis. Politics, if done right, is supposed to find win/win solutions ... yet Mr. Boehner and his team managed to come up with a lose/lose/lose proposition, unacceptable to both Democrats and Republicans, unacceptable to both technocrats and partisan hacks.

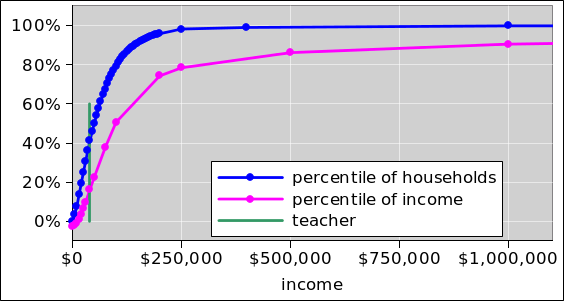

As a first step toward understanding what’s going on, let’s look at figure 1. For any given income, the blue curve tells where that income ranks among all household incomes. For example, consider a salary of $40,000.00, which is slightly more than the starting salary for a TUSD teacher. As indicated by the dark-green vertical line in the figure, this corresponds to the 40th percentile, according to Census Bureau figures. In other words, 40% of all households get by on less than $40k.

Also in figure 1, the magenta curve shows where a given income ranks as a percentile of the total income. For example, households making less than $40,000.00, if you put them all together, take home about 20% of all the income. This is based on IRS statistics. The blue curve shows that there are very, very few households making more than half a million dollars per year, while the magenta curve shows that these households account for a very significant fraction of the total income.

Now that we understand these two percentile curves, we can get an even clearer picture of what is going on by plotting one percentile against the other, as in figure 2. The teacher’s salary is represented by the green dot. As before, it ranks near the 40th percentile on the list of households, and slightly below the 20th percentile in terms of total income.

The upper-right part of the income-distribution curve is exceedingly steep. You can more clearly see what’s going on in figure 3, where the vertical axis has been zoomed by a factor of 4, and the horizontal axis has been zoomed by a factor of 50. This decreases the slope by a factor of 12.5 ... and even then, the slope in the high-income region is huge. This slope has a simple interpretation: it tells us that this segment of population is getting more than its share of the income, more by a truly astonishing factor.

We begin to see why Plan B is such a lose/lose/lose proposition. We start by considering just the threshold:

These are the people with the most disposable income. They have the most ability to pay taxes; they just don’t want to. Evidently buying a politician is cheaper than paying taxes.

Plan B also contains some wacky features other than the threshold. Notably, it would have caused taxes to go up for low- and middle-income taxpayers, by doing away with things like the earned income tax credit, the child tax credit, and the payroll tax cut that was enacted as part of the 2009 stimulus bill.

There is one more factor to be considered, namely the fact that the bill had no chance of being voted on in the Senate, much less passed by the Senate. Therfore the vote in the House was purely symbolic. In theory, this factor could work either way, making it easier or harder to vote for the bill. Generally, though, this factor rarely has much effect. That is, if a symbolic issue is clearly connected to a substantive issue, the voting on one will generally parallel the other. There can be exceptions in cases where proponents are paying attention and opponents are not, but that is certainly not the case here.

This leads to another set of questions, i.e. questions about the Congressional Republicans’ reaction to the Obama proposal.

In light of point 4 above, you would think that at least 98% of voters would support the Obama plan. Forsooth, in light of points 2, 3, and 4, plus the fact that individuals earning slightly more than $250k would pay only very slightly more tax, you would think that more than 98% of the voters would support the Obama plan.

In fact, though, the $250k threshold is supported by “only” about 70% of the voters.

So, why would elected “representatives” oppose something that is supported by a such a strong majority of the voters? This is not supposed to happen.

Far and away most plausible explanation is that the ultra-super-rich donors have bought the politicians, in order to buy a tax policy that favors their short-term selfish interests ... while sacrificing good governance and harming the overall economy.

There’s a word for this. It’s called bribery. It’s illegal. We ought not tolerate it, not even for an instant.

Those fat cats are not job creators; they’re corruption creators.

To be diligent and thorough, we should consider other hypotheses, such as ideology. Maybe these guys are just opposed to taxes on principle. That sounds nice, but it doesn’t fit the facts. These guys are perfectly happy to raise taxes on not-very-rich people. Plan B would have raised taxes on low- and middle-income taxpayers.

To more directly support the point about general ideology (as distinct from Plan B in particular), consider the so-called Ryan budget. It was approved by virtually all House Republicans, and would have raised taxes on the bottom 20% of taxpayers. Along the same lines, note that three of the top candidates for the 2012 Republican presidential nomination touted highly regressive flat-tax proposals. This was discussed by The Economist:

This time around, however, raising taxes on the poor seems to be a point of pride among Republican candidates,

More generally, I’m not impressed by the ideology of people who have a track record of changing their ideology at the drop of a hat.

With these guys, they figure out what result they want and then invent an unalterable principle that will produce that result. This point was recently discussed by Jonathan Chait:

The habit of formulating arbitrary rules, and subsequently discarding them, is becoming a key feature of the Boehner speakership. Boehner’s speakership is a years-long game of Calvinball.

There’s nothing new or special about this. Every crook I’ve ever known had a reason why it was necessary for him to do what he wanted to do.

Copyright © 2012 jsd